Thinking about buying property through your super? You’re not alone. Many Australians are exploring SMSF…

The Pros and Cons of Self-Managed Super Funds

A Self-Managed Super Fund (SMSF) is a superannuation fund that allows individuals to take full control of their retirement savings.

Unlike traditional super funds managed by financial institutions, an SMSF is run by the members who act as trustees. This means they are responsible for making investment decisions and ensuring the fund complies with Australian regulations.

Self-Managed Super Funds offer many benefits, but come with risks and responsibilities. Let’s explore the pros and cons of a Self-Managed Super Fund (SMSF) to help you determine if it’s the right choice for you.

The benefits of SMSFs

#1: Complete control over investments

One of the biggest advantages of an SMSF is that you have full control over where your superannuation is invested. In traditional super funds, investment decisions are made by fund managers, but with an SMSF, you decide how to allocate your funds. This may include investment options like direct shares, ETFs, cryptocurrencies, managed funds, term deposits, and private businesses.

This means you can tailor your investment strategy to match your financial goals, risk tolerance, and personal preferences.

#2: Estate planning advantages

SMSFs provide more flexibility in estate planning. Members can nominate specific beneficiaries and set up binding death benefit nominations that ensure their super savings are distributed according to their wishes.

This can be especially useful for people with complex family structures or those who want greater control over their assets after their death.

#3: Cost savings for larger balances

While SMSFs have setup and management costs, these expenses can become more cost-effective as the fund balance grows. Large super balances (typically over $200,000) can reduce the per-member cost compared to the fees charged by retail or industry super funds.

For people with high super balances, an SMSF may offer better value for money.

#4: Ability to purchase commercial property

One unique benefit of an SMSF is the ability to invest in physical commercial property, which is not an option with traditional super funds. Business owners can use their SMSF to purchase commercial property and then lease it back to their business at market rates.

This arrangement can provide a stable source of rental income for the SMSF while allowing business owners to pay rent to their own superannuation fund instead of an external landlord.

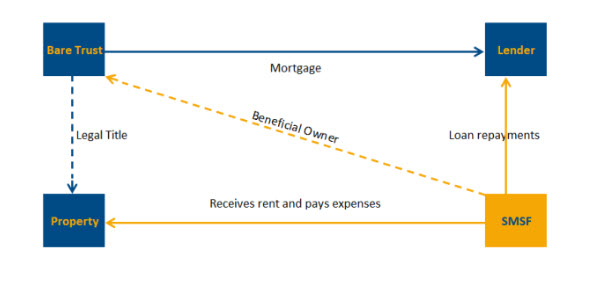

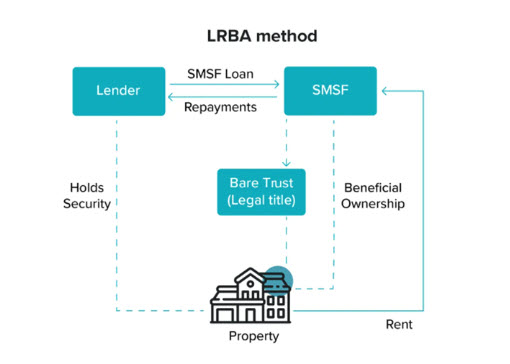

SMSF trustees have multiple distinctive methods for acquiring property within their fund, each catering to different needs and circumstances. One of those methods is Limited Recourse Borrowing Arrangement (LRBA).

SMSFs can borrow money from banks, financial institutions, or related parties to buy property through a Limited Recourse Borrowing Arrangement (LRBA). This arrangement requires the creation of a separate custodian (bare) trust to hold the property legally.

The downsides of SMSFs

#1: Cost of managing the fund

While SMSFs can be cost-effective for those with high balances, they can be expensive for those with smaller super amounts. There are upfront costs to set up the fund and ongoing fees for administration, auditing, and compliance.

If the balance is too low, these costs may outweigh the potential benefits of having an SMSF.

#2: Time-consuming and complex

Managing an SMSF requires a significant time commitment. As a trustee, you are responsible for researching investments, monitoring market conditions, keeping records, and ensuring the fund complies with all legal requirements.

Unlike traditional super funds, where the super trustee and fund managers handle these tasks, SMSF members must actively manage their own fund, which can be overwhelming for those with little financial experience.

#3: Strict legal and regulatory responsibilities

SMSFs are regulated by the Australian Taxation Office (ATO), and trustees must comply with all rules and reporting requirements. This includes annual audits, tax returns, and financial statements.

If the SMSF fails to meet its obligations, it could lose its concessional tax treatment or even be penalised by the ATO.

#4: Difficulty in exiting the fund

Closing an SMSF is not as simple as selling assets and withdrawing funds. Winding up an SMSF requires strict legal processes, including finalising tax returns, paying off any liabilities, and ensuring all members receive their share of the remaining balance.

This can be a lengthy and complex process that requires professional assistance.

SMSFs can be a powerful tool for those who want more control—but it comes with crucial considerations

An SMSF can benefit those who want more control over their retirement savings, offering benefits such as investment flexibility, tax advantages, and the ability to purchase commercial property. However, it also comes with significant responsibilities, including regulatory compliance, ongoing costs, and the need for investment expertise.

SMSFs are best suited for those with larger balances, financial knowledge, and the willingness to dedicate time to managing their fund.

Before deciding whether an SMSF is right for you, carefully weigh the pros and cons. Seeking professional financial advice from experts like Elliot Watson Financial Planning can help ensure you make an informed decision that aligns with your long-term retirement goals.

Contact our team for more information about SMSFs. Our financial advisers can help find the ideal solution for your personal circumstances and future goals.

Disclaimer:

The information within, including tax, does not consider your personal circumstances and is general advice only. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information, you should consider its appropriateness regarding your objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser.

The views expressed in this publication are solely those of the author; they are not reflective or indicative of the licensee’s position and are not to be attributed to the licensee. They cannot be reproduced in any form without the author’s express written consent.

Elliot Watson Financial Planning Pty Ltd and its advisers are Authorised Representatives of RI Advice Group Pty Ltd, ABN 23 001 774 125 AFSL 238429.