Our team at Elliot Watson Financial Planning have shared their top tips for the new…

Financial tips for starting out: Building strong foundations for your future

Starting out in your financial life can feel overwhelming — whether you’ve just landed your first full-time job, are moving out of home, or are starting to save for bigger goals like travel or buying a home. The truth is, the earlier you start taking control of your finances, the more freedom and opportunity you’ll create for your future.

Here are a few key tips to help you start strong.

#1: Pay yourself first

Image: Freepik

The simplest wealth-building habit is also the most powerful: save before you spend. As soon as your income hits your account, automate a portion straight into a savings or investment account. This could be 10–20% of your pay; consistency is key. By paying yourself first, you prioritise your future before lifestyle creep kicks in.

Tip: Set up separate “buckets” for savings goals like an emergency fund, investing, or travel. Out of sight, out of mind — and less temptation to spend.

#2: Build a safety net

Unexpected expenses happen — car repairs, medical costs, time off work — and they’re far less stressful when you have an emergency fund.

Aim for at least three months of expenses in an easily accessible account. It’s about protecting your financial stability and giving you peace of mind.

#3: Understand and manage your cashflow

Image: Freepik

It’s easy to lose track of where your money goes. Take the time to map out your income and essential expenses, then decide what’s left for lifestyle and savings.

If you find yourself wondering where your money disappears each month, see the link below to a budget. Utilising your bank tracking system can help you regain control and align your spending with your goals, and show you trends in spending.

#4: Make the most of superannuation early

Younger Australians often overlook superannuation, but it’s one of the most tax-effective ways to build long-term wealth. Even small extra contributions can compound significantly over decades, while utilising personal concessional contributions as a taxation-effective strategy.

This can be set up as a salary sacrifice arrangement with your employer, where the contribution comes out of your pay before it reaches your bank account.

Example: Adding just $50 a week to your super from age 25 could mean tens of thousands more by retirement.

#5: Avoid “bad” debt

Image: Freepik

Credit cards, buy-now-pay-later services, and personal loans can quickly erode your income and delay your financial goals. Before borrowing, ask yourself: Will this purchase increase my long-term wealth, or will it just provide short-term satisfaction?

Not all debt is bad — a mortgage or education loan can be strategic — but high-interest consumer debt should be avoided at all costs.

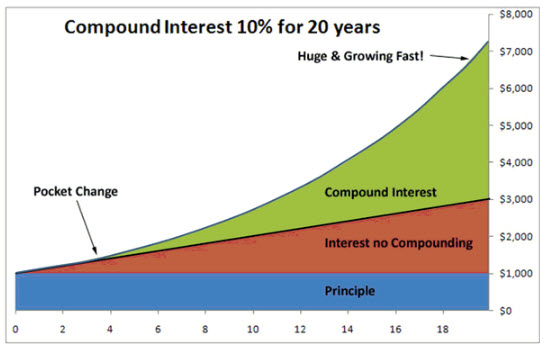

#6: Start investing early

The earlier you begin investing, the more time your money has to grow through compound returns. You don’t need thousands to start — with platforms now offering low minimums and investments providing diversification, it’s never been easier.

The key is consistency and patience — don’t try to time the market; focus on staying in the market over time.

#7: Protect what you’re building

Image: Freepik

As your financial life grows, so does the need to protect it. Insurance, such as income protection, total and permanent disablement, traumatic event, and life cover, can safeguard your goals if something unexpected happens.

Likewise, having basic estate planning documents (a will, powers of attorney) ensures your wishes are clear and your loved ones are looked after.

#8: Get professional advice early

A financial adviser can help you build structure and confidence from day one — setting up the right strategies, identifying opportunities, and helping you avoid costly mistakes. Good advice isn’t just about wealth; it’s about clarity, direction, and knowing your money is working toward your goals.

Take the next step towards your financial future

Financial success rarely happens overnight — it’s the product of small, consistent decisions made over time. Start with the basics: save regularly, manage debt, invest early, and protect what matters. The sooner you take charge, the sooner your money starts working for you — not the other way around.

Get started with Elliot Watson Financial Planning today. We’re here to help make wealth-building simple and ensure you’re set up for future financial success. Contact us to book an appointment with our team.

Article by Izack Fuller – Financial Adviser

Disclaimer:

The information within, including tax, does not consider your personal circumstances and is general advice only. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information, you should consider its appropriateness regarding your objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. The views expressed in this publication are solely those of the author; they are not reflective or indicative of the licensee’s position and are not to be attributed to the licensee. They cannot be reproduced in any form without the author’s express written consent. Elliot Watson Financial Planning Pty Ltd and its advisers are Authorised Representatives of RI Advice Group Pty Ltd, ABN 23 001 774 125 AFSL 238429.