“There is nothing like staying at home for real comfort” — Jane Austen. As we…

The Support at Home Program: What the aged care reforms of 2025 mean for your family’s wealth

Big changes are coming to aged care, affecting how support is accessed, funded, and delivered across Australia. Whether you’re planning for your own future or helping a loved one navigate care options, it’s essential to understand these aged care changes and why they are happening.

From November 1, 2025, the government is rolling out the most significant aged care reforms in over 30 years. These changes aim to improve the quality of care, empower older Australians with stronger rights, and reshape how services are assessed and funded. But with new rules, costs, and pathways, the system is becoming more complex, and understanding it is key to making informed decisions.

This article explains what’s changing, why it matters, and how you can prepare, whether you’re seeking in-home support, considering residential care, or simply want to understand how financial advice can help you or your family navigate the journey ahead.

Understanding the aged care changes from November 1 2025

People need support as independence declines, and Aged Care Services can assist in maintaining a person’s dignity and quality of life during the twilight years. Services may be sought due to a variety of reasons, including:

- Declining physical health and an inability to complete daily tasks such as cleaning your home, meal preparation and essential personal care.

- Cognitive conditions, such as dementia, that impact decision-making and the ability to live independently.

- Mitigating safety concerns from the risk of falls through home modifications or support living environments

- Reduced social interaction due to a smaller friend and family network, and reduced mobility

- Essential medical monitoring, such as medication management and rehabilitation services

- Carer fatigue or burnout of partners, family members and friends who assist in the care partnership.

When will the new Aged Care Act commence, and what’s changing?

The most significant changes will take effect starting November 1, 2025. By requiring wealthier individuals to contribute more toward the cost of their care, the government expects to save around $12.6 billion over the next decade.

Key feature #1: Rights-based Aged Care

A new rights-based framework, including replacing the Aged Care Act 1997 to 2024, incorporates a person-centred approach, a new statement of rights when accessing services, and strengthened quality standards. The new Act aims to improve how services are delivered to older people in their individual or residential homes and community settings.

Key feature #2: A single assessment model

From July 1, 2025, older people will be assessed for the In-Home Support Program through the new single assessment model.

Once an assessment has been completed, a notice of decision will be handed down that may contain a summary of goals and care needs, an ongoing budget based on classification and approval for short-term supports that can include assistive technology or home modifications, restorative support in the form of allied health provisions or end-of-life care.

Key feature #3: Support at Home Program

The Support at Home Program will launch on 1 July 2027, combining the Home Care Package and Short-Term Restorative Programs (2025) and transitioning Commonwealth Home Support. The program will have eight classifications for ongoing services, replacing the current four Home Care Package program levels.

Home supports budgets are broken into quarterly amounts, and new classifications are below. Current HCP clients will be allocated a budget that aligns with their current level.

Budget Classification Table

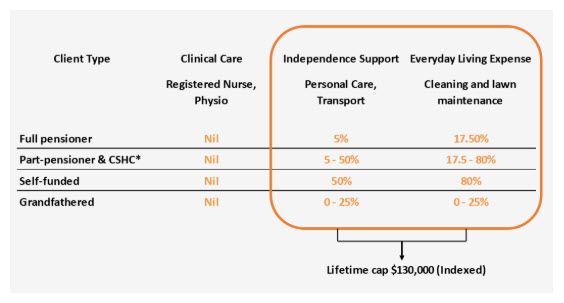

Under the new model, clients will have greater contribution levels proposed. The client will pay a dollar amount set as a percentage, and the government will pay the remainder of the price as a subsidy to the provider.

These contributions will be based on the type of service received and the client’s pension status up to a lifetime indexed cap of $130,000.

Pension status

- Lowest contributions for full pensioners

- Moderate contributions for part pensioners

- Highest contributions for self-funded retirees.

Service status

- No contribution will be required for clinical services (Nursing)

- Moderate contributions for independence services such as personal care

- Highest contributions for everyday living services such as Cleaning and lawn maintenance.

Example of potential costs between a full pensioner and a self-funded retiree on Level 5

Pathways have been set up through the program to access a maximum of $15,000 in assistive technology or home modifications, 12 weeks of restorative care focusing on allied health, and end-of-life care of up to $25,000.

Key feature #4: Residential Aged Care

In 2025, the maximum permissible Refundable Accommodation Deposit (RAD) threshold will increase from $550,000 to $750,000. The Residential Aged Care provider may charge this fee when you or a loved one enters care, which can create financial challenges for a family.

- Providers can also retain 2% of the Refundable Accommodation Deposit (RAD) per annum for up to five years.

- The Daily Accommodation Payment (DAP) will be indexed.

- The Means-Tested Fee (MTF) will be replaced by new Hotelling and Non-Clinical Care Contributions (NCCC).

Entrant eligibility will be determined by:

- Old Rules – Permanent entry date before November 1, 2025.

- Grandfathered Rules – Permanent entry date after November 1, 2025, but has to be approved/receiving a Home Care Package (HCP) before September 12, 2024.

- New Rules – Permanent entry date after November 1, 2025.

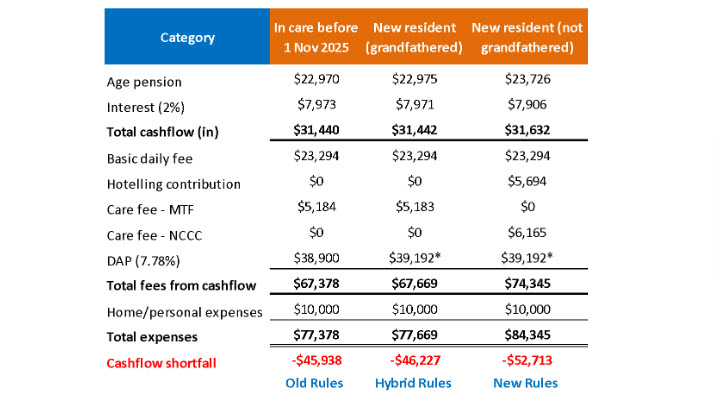

The example below is based on the Day 1 entry for a resident who is a member of a couple with assessable assets of $631,663.20.

Aged care fees explained: What is RAD and DAP in aged care?

Residents entering an aged care facility usually need to pay upfront to cover their accommodation. This can be done through a RAD (Refundable Accommodation Deposit) or a DAP (Daily Accommodation Payment).

A RAD is a lump sum payment made to the aged care home. It’s fully refundable when the resident leaves, minus any agreed fees. On the other hand, a DAP is more like “rent” – a daily payment that doesn’t need a large upfront sum but isn’t refunded. Some people choose a combination of both, paying part as a RAD and the rest as a DAP.

This flexibility helps families manage finances depending on whether they prefer to preserve cash flow or minimise ongoing expenses.

Key feature #5: Financial adviser help

A financial adviser can be helpful when navigating aged care in Australia, which can be emotionally and financially complex. Here’s how they can support someone entering residential aged care or receiving home care:

Why speak to a financial adviser about the upcoming Aged Care changes?

A financial adviser can break down and explain the types of fees involved in aged care, such as:

- Eligibility, entrant rights being grandfathered, or new rules.

- Basic Daily Fee: Covers everyday living costs.

- Means-Tested Care Fee: Based on income and assets.

- Accommodation Payments: Can be paid as a lump sum (RAD), daily amount (DAP), or a mix.

- Extra/Additional Service Fees: For higher comfort levels or extra services.

Cash flow & asset planning

- Assessing whether to sell or keep the family home to pay for accommodation costs.

- Structuring income and assets to maximise age pension entitlements.

- Planning to reduce means-tested fees where legally possible.

Family home considerations

- Deciding whether to sell the home can have tax and Centrelink implications.

- Advisers help weigh the financial pros and cons, including how it affects aged care fees and pension eligibility.

Centrelink & pension advice

- Help complete Centrelink forms like the SA457 and manage the aged care means test.

- Provide strategies to retain or increase pension entitlements while entering care.

Estate planning & gifting

- Advisers can collaborate with lawyers to ensure aged care plans fit with estate planning goals.

- Guidance on gifting rules and avoiding unintended consequences like increased fees or reduced pension.

Ongoing advice

- Regular reviews of care needs, funding arrangements, and fees.

- Adjust financial plans as health or living situations change.

Support for Families

- They often help families navigate tough decisions and ensure all options are clearly understood, e.g. support at home or in an aged care home, and the financial implications of both. With a financial adviser, you can learn how to avoid selling your home to pay for care.

If you’re considering aged care for yourself or a loved one, contact Elliot Watson Financial Planning for advice

Do you want help finding specific strategies or examples of how advice is tailored to each person’s situation? Don’t just source your information from Services Australia—it’s easy to get lost in the jargon. Contact the team at Elliot Watson Financial Planning for professional aged care advice and create an actionable plan for your family’s future.

Disclaimer:

The information within, including tax, does not consider your personal circumstances and is general advice only. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information, you should consider its appropriateness regarding your objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser.

The views expressed in this publication are solely those of the author; they are not reflective or indicative of the licensee’s position and are not to be attributed to the licensee. They cannot be reproduced in any form without the author’s express written consent.

Elliot Watson Financial Planning Pty Ltd and its advisers are Authorised Representatives of RI Advice Group Pty Ltd, ABN 23 001 774 125 AFSL 238429.

Article by Geoff McQueen – Provisional Financial Adviser